To have a fully functioning eCommerce website, you need to have an array of payment methods. To be successful, your website needs to have a lot of functions, and ranking high on that list of functions is an eCommerce payment gateway. There’s no way to avoid a payment gateway on your eCommerce website.

You need to have multiple options that serve a wide customer base, is safe and secure. In this article, we’re going to discuss everything you need to know about eCommerce payment gateway and the best eCommerce payment gateways for your eCommerce business.

Without further ado:

What is an Ecommerce Payment Gateway?

To put it simply, an eCommerce payment gateway is a platform that’s solely responsible for all the transactions that happen in your eCommerce store.

To process a payment on these payment platforms, all that’s needed in most cases is the user’s credit or debit card. The payment gateway does all the job for you and all you need to do is integrate it into your eCommerce website.

It doesn’t matter if you sell your products or you’re a dropshipper, eCommerce payment gateways work all the same. There are several payment platforms available, before we go into discussing them, let’s look at how to choose the best eCommerce payment gateway for your business.

What to Consider Before Choosing an Ecommerce Payment Gateway

Knowing that no two eCommerce payment gateways are the same, here are some things to consider before choosing a payment gateway.

- Security: One of the major problems associated with shopping online is security. Users are wary of putting their card details on just any platform, this is why you must make sure security is the most important thing on your mind as you search for eCommerce payment gateways.

- User Experience: Complexity is one of the biggest reasons customers drop off before making a purchase. If your payment methods are too difficult to navigate, you’re going to experience a lot of drop-offs in the payment phase.

Cart abandonment is one of the issues plaguing eCommerce, and one of the biggest reasons for cart abandonment is a stressful or hectic payment gateway. Hence, you must choose a payment gateway that’s as seamless and easy to navigate as possible.

NB. Make sure your choice works well both on PC and on mobile.

- Hosted or Integrated Payment Gateways?

The difference between a hosted and an integrated gateway can be gleaned from the name.

An integrated payment gateway is a gateway that fuses seamlessly with your eCommerce website. This is made possible by the use of APIs. One of its many advantages is that customers don’t have to leave your store to make payment.

A hosted payment gateway is a payment gateway that leads your customers to the payment system’s platform. Hosted payment gateways are very easy to set up and are generally advisable for new stores. The only downside to the hosted payment gateway is that customers may drop off if they’re unfamiliar with the payment system’s platform.

- Fees: Fees vary with each payment gateway. Before choosing a payment gateway, you need to make sure the setup charges are well within your budget and aren’t extravagant when compared to other payment gateways. You need to make sure it has everything you need and also importantly, that it fits your budget.

- Business Vision: While this may seem like a vague point, we’ll break it down further. You need to understand the basis of your business before choosing to opt-in for a payment platform. Are you serving local customers? Are you looking to expand soon? Are you serving customers globally? These are all questions you need to answer before choosing a payment platform.

In the case of serving customers worldwide, you’ll need to choose payment gateways that work globally. Your payment methods need to meet your customers where they are and not the other way around. When a potential customer gets to the payment page of your website, they should meet familiar payment gateways. This way, you’re not leaving anyone out.

- Customer Support: Some payment gateways don’t offer any form of customer service, as such customers would have to self-help and solve problems themselves. To avoid an occurrence like this, you need to make sure your chosen gateway has great customer support that can resolve problems and answer queries almost immediately they come up.

Top ECommerce Payment Gateway

We’ve put together a list of the best eCommerce payment gateways for fast and secure checking out.

- Stripe: Stripe is easily one of the best payment methods available today due to its versatility. Stripe is a great payment platform because it is extremely user-friendly integration APIs and is great for eCommerce businesses.

With Stripe it’s easy to set up reoccurring payments for returning customers.

If you run a brick and mortar store as well, stripe also has POS services.

Research has shown that eCommerce websites using Stripe were able to grow their revenue by 6.7% after integrating the payment platform.

Stripe accepts major credit and debit cards from all countries. You can also integrate other payment alternatives into Stripe, such as Google Pay, Apple Pay, Masterpass, American Express Checkout, etc.

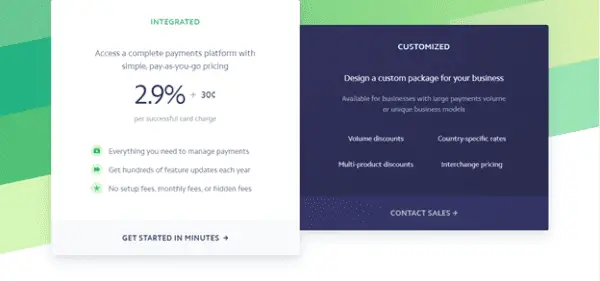

Pricing.

Stripe has standard pricing.

- PayPal is easily the most popular web payment platform. PayPal has created a reputation for being easy to use, reliable and secure. There are more than 377 million active PayPal users worldwide.

PayPal is a favourite for many reasons, especially if you’re just starting your eCommerce business. This is because almost everyone is familiar with PayPal and the way it works, also, it’s extremely easy to integrate into your eCommerce website.

Also, customers may have a PayPal balance they would like to use to purchase on your website. This way, they don’t have to use their cards or anything.

Research has also shown that websites with PayPal as a method of payment convert 82% higher than websites without PayPal. PayPal accepts Credit and Debit Cards, Venmo, PayPal, PayPal credit, etc.

Pricing

Ecommerce stores in the US cost 2.9% + $0.30 per transaction.

International sales cost 4.4% per transaction.

- Square is a great choice as a payment gateway. What makes Square stand out among the rest is its unique eCommerce website builder. Square’s website builder lets you build a great drag-and-drop website without any code. Square can be easily integrated into common eCommerce platforms.

Pricing

Like Stripe and Paypal, Square costs 2.9% + $0.30 per transaction.

- Payoneer is a unique payment system for eCommerce businesses compared to Stripe, PayPal or Square. What makes Payoneer different then? The difference is centred on the fact that Payoneer isn’t a merchant system. This means they do not allow payments via debit cards or credit cards. What they do is set up an account for your business with your local bank and accept bank transfers instead.

Based on your locale or the kind of product you sell or the service they render, Payoneer would be an exceptionally great offer. If you have more overseas customers, Payoneer is a great option.

Pricing

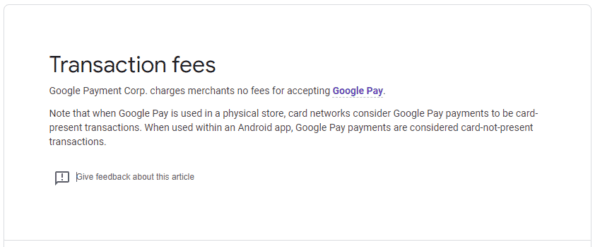

- Google Pay is a wallet made by… well, you guessed right. Google Pay was specially designed for ECommerce shops, in-person checkouts and mobile apps.

What makes Google Pay unique is the fact that with just a click customers can complete their purchases and check out almost immediately. With the level of speed delivered by Google Pay, the issue of cart abonnement is greatly reduced.

Google Pay is extremely easy to integrate with other payment platforms that may already be on your site.

- Apple Pay as said earlier in this article, your eCommerce website should offer an array of payment options. One of those you should consider is Apple Pay. Apple Pay is aimed at making payment especially smoother for mobile phones. With Apple Pay, customers can handle payments using Face ID and Touch ID.

Like Google Pay, its focus is on encouraging users to maintain an electronic wallet. Like PayPal and other payment gateways, Apple Pay can be integrated into these payment gateways.

For eCommerce businesses that have a lot of customers in the Apple ecosystem, making Apple Pay a payment option on your website is advisable. This is because over 43% of all iPhones available use Apple Pay.

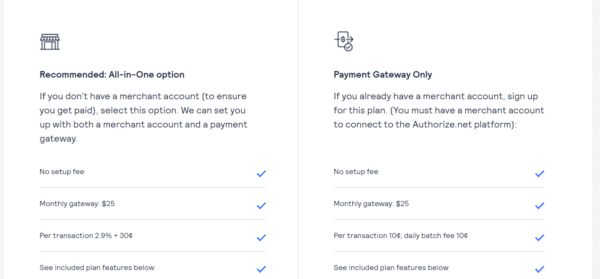

- Authorize.net is one of the oldest payment methods available. Authorize.net is great as it is relatively easy to set up and it serves customers from all over the world. Authorize.net allows integration in almost all eCommerce websites.

Authorize.net is one of the few payment gateways that allow integration with PayPal. If you have a brick and mortar store, also offer POS systems.

Pricing

- Alipay If your eCommerce business model serves a lot of Chinese customers, integrating payment methods that allow them to pay with ease would do a world of good for your business. With over 600 users, Alipay is one of the most widely used payment systems in China.

Pricing

Alipay charges an average of 0.55% percent.

Conclusion

If customers are unable to pay for goods on your eCommerce website, the purpose of the business is ultimately defeated.

To select the right payment gateway, you need to understand everything about your business and where your customers come from. If you service China, it would make sense to prioritize Alipay, if most of your customers are iPhone users, one of your top payment systems should be Apple Pay. The list goes on and on.

To round it off, by understanding your customers you’re already halfway through the best payment gateway.

NB: No rule says too much payment option is bad. What this means is that you should stack as many payment gateways as possible.