If there is one thing we can all agree on, it’s the fact that the rate of international transactions has grown rapidly in recent times. And with the increasing popularity of e-commerce, freelancing, remote working and all things virtual, it’s only expected to continue on its upward trajectory in the foreseeable future. All of this is possible because of digital payment service providers like Payoneer.

In this Payoneer review, we’ll talk about how the e-payment provider contributes to the success of businesses and how it can contribute to yours too. We’ll also look at its features, pricing, how it works, its pros and cons. We hope that you find this Payoneer review useful in your search for an e-payment service for your business and personal use.

About Payoneer

Payoneer Global Inc. was founded as a private equity company in the year 2005 in New York. It was founded by Yuval Tal, a fintech enthusiast who’s passionate about revolutionising payments.

As a commerce technology giant, it’s promoting the growth of businesses around the world by facilitating payments across socio and geopolitical borders. It doesn’t matter whether you’re running a small business somewhere in Southeast Asia or part of a conglomerate in Germany. It doesn’t even matter whether you’re a digital nomad travelling the world, Payoneer promises to ensure you can always get paid.

The global payment service was listed as one of Forbes Top 50 fintech companies in 2020. And in June 2021, it became a public equity company in a $3.3 billion merger. Curious about how well this fintech leader fits your business’s needs? Go on and read through the rest of our Payoneer review for answers.

How To Register For A Payoneer Account

Creating a Payoneer account is easy and absolutely free. Thanks to its intuitive sign-up flow, the Payoneer registration process is simple and can be completed in minutes. There are 3 major steps to setting up your Payoneer account: apply, review and start receiving payments.

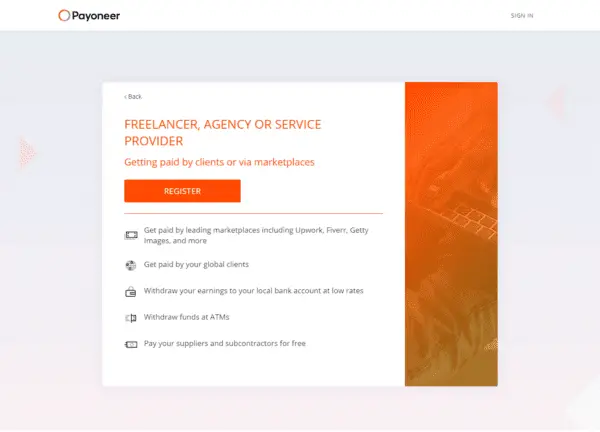

To apply, click on the “REGISTER” button on the homepage. A page where you get to choose, from a short list, who you are and what you want to do with your Payoneer account comes up. As of the time of writing this Payoneer review, the options listed include:

- Freelancer or SMB

- Online seller

- Affiliate marketer

- Vacation rental host

- Individual

If you’re a freelancer or SMB (small and medium-sized business), not only will you be able to receive payments from global clients, marketplaces like Fiverr, Upwork, Getty Images, iStock etc. can also send you payments.

As an online seller signing up to the Payoneer service, you’ll be informed that you’ll be able to get paid by leading online marketplaces, pay your suppliers for free, pay VAT and manage more than one Amazon store.

As an affiliate marketer, in addition to getting paid by affiliate networks and platforms, you’ll also be able to pay your affiliate traffic from your Payoneer balance.

If you’re a vacation rental host, you can receive payments from Airbnb and HomeAway via the Payoneer service. You can also pay your suppliers and subcontractors for free.

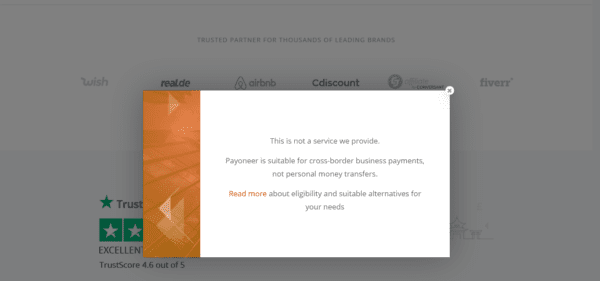

As an individual registering on Payoneer, even though there are 3 options on the drop-down list, the only thing you can do on Payoneer is to receive payments from clients and marketplaces. Clicking on any of the other options (“order a prepaid card” and “send and receive money between family and friends”) lead to a pop-up box informing you that Payoneer doesn’t provide the service. We were going to leave this out but we promised a detailed Payoneer review so here we go.

Now, you’re probably wondering what information you’ll need to create a Payoneer account. Don’t worry, that’s the next thing we’ll be talking about in this Payoneer review.

Payoneer registration requirements

At the start of the application process, you’ll be filling a few forms – simple stuff. It’s organised into a 4-step process where you’ll provide the required information. Some of the information that’s requested include:

- Your full name (Make sure to use the name that’s on your government-issued ID)

- Email address (This is where all of Payoneer’s emails to you will end up so make sure it’s readily accessible by you)

- Date of birth

- Residential address

- Phone number (Payoneer will send your verification codes to this number so ensure it’s working)

- Government-issued ID type and number

- Bank name, account holder name and account number (That’s the bank that you’ll like Payoneer to pay your funds into)

It might look like a lengthy process from here (because we want to give you as much information as possible) but trust us, it only took a few minutes. We did test the process for this Payoneer review after all.

N.B: The field for the account holder’s name comes pre-filled and can only be changed by going back to the first step (where you filled out your full name) and correct it. Make sure to use your name as it is on your ID so that payments from Payoneer to your local bank can be approved.

In the third step of the application, you’ll be asked to create your password. You’ll also choose a couple of security questions too as an extra security measure.

At the end of your application, an email will be sent to notify you that your application is being reviewed. It’ll also state how long you’d need to wait for an email notifying you of approval. As we tested the platform for this Payoneer review, our email notification said it’d take up to 3 business days but it arrived in less than an hour.

After your application is approved, you can start receiving payments. However, even though you can receive payments, your registration isn’t complete yet. You’ll sign in to your Payoneer account and complete the final phase of the registration process: verification.

How to verify Payoneer global payment service

To be able to withdraw funds from your Payoneer account to your local bank, you need to verify it by supplying relevant information and documentation.

Like any other financial institution, Payoneer is subject to its industry’s rules and regulations. To avoid delays with accessing your payments, you should complete the verification process as soon as possible.

Here’s how to do that (because our Payoneer review is helpful like that):

- Sign in to your Payoneer account.

- Go to the top left side of your dashboard and click on “Settings”.

- A drop-down list will appear, click on “Verification Center”.

- Next, click on the “Account Verification” and “Provide Business Details” tabs to see which documents you’re required to provide.

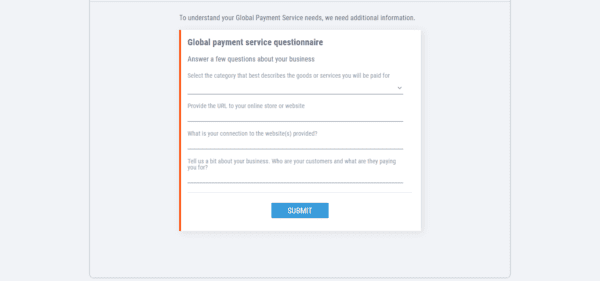

- Follow the instructions, fill out the questionnaire, upload the requested document (government-issued ID) and submit.

- To see the documents you’ve submitted, click on “History”.

Here are some helpful tips that can help you complete the global payment service questionnaire correctly:

- If you’re an online seller using marketplaces such as Amazon, eBay, or Etsy, you can provide a link to your store. Your store should be active and have items listed for sale.

- If you’re selling on your own website using a payment processor like PayPal, Skrill or WePay, fill out your website’s link. You’ll also supply a description of your products or services.

N.B: You’ll need to prove that you own or manage the website. To do that, include a link to a page that shows your name or send Payoneer a “whois” report. Another way is to upload a test file to the domain with the “Global Payment Service verification” text.

- If your business is on social media, provide a link to your social media business account instead.

- For freelancers using freelance platforms, providing a link to their most active profile on any of the platforms will do. Ensure your job history can be viewed.

- As an affiliate marketer with online affiliate networks, provide a link to the website you generate your affiliate traffic with.

- If you do not have a website but will be receiving payments from a company(s), specify this by including its (or their) URL.

- Use simple words to explain what your connection to the website is (own, co-own, administer etc).

Here’s what we like about Payoneer’s registration process:

- Thanks to the helpful notes that explain what’s being requested, it’s easy to fill out the forms to create a Payoneer account.

- Fast account review and approval. We didn’t have to wait for the 3 business days as promised.

- The security of the users’ accounts is taken seriously as can be seen with the use of 2-step verification.

Here’s what we don’t like about Payoneer’s registration process:

- The global payment service verification process takes about 30 days. However, there are lots of complaints from users about verification problems which makes the process much longer.

How to get paid with Payoneer

There are several ways to get paid or receive money with the Payoneer service. You can receive payments from companies in the US, UK, EU and Japan via the Global Payment Service feature. With the “Make Payment Request” feature, you can also directly send payment requests to your clients and customers. And if you’re using supported marketplaces (like Amazon, Fiverr etc), simply choose Payoneer as your preferred payment method.

To get paid from international companies:

- Click on the “Receive” tab in your Payoneer dashboard.

- Select “Global Payment Service” from the drop-down menu.

- You’ll be provided with a receiving account from the country’s country.

- Send the details of provided receiving account to the company paying you.

- It’ll use the details to send the funds via a local bank transfer and the payment will be sent to your Payoneer account.

To bill or send payment requests to individuals (your clients and customers):

- Click on the “Receive” tab in your Payoneer dashboard.

- Select “Request a Payment” from the drop-down menu.

- Follow the instructions, provide the requested information and submit.

- Your client will be sent an email with your payment request and Payoneer link.

- They can make the payment online or through their bank account and the money will be deposited in your Payoneer account.

Payoneer-to-Payoneer payments

This is the quickest method of sending money on the e-payment platform. Payoneer-to-Payoneer transfers are usually completed within a few hours and they don’t attract any charges. This means that sending money from one Payoneer account to another is fast and free.

Pay suppliers, contractors and remote workers with Payoneer

Payoneer helps companies like Upwork, Fiverr, Airbnb etc facilitate the payment of freelancers and contractors via its Mass Payout Account solution. If your business employs virtual assistants, freelancers or other remote workers, you can check to see how this Payoneer’s feature can help your business pay them. has to routinely pay The payments can be made in batches, to several contractors at the same time. Payments can be scheduled ahead of time, which is perfect for salaried staff.

Here’s what we like about Payoneer’s payment feature:

- The ability to link your Payoneer account to popular freelancing platforms like Upwork, Fiverr and companies like Airbnb. It’s an easy way to receive all your payments in one place.

Here’s what we didn’t like about Payoneer’s payment feature:

You can’t request a payment if you haven’t received up to $5,000 with your Payoneer account via the global payment service or mass payout companies (partner marketplaces). When we tried to request a payment without meeting this condition, we found that the “Request a payment” option wasn’t available. Now that’s a bummer.

Is Payoneer safe to use?

If you’ve got fears about Payoneer’s legitimacy, you can lay them to rest. Not only is Payoneer FDIC insured, it’s a fully regulated US financial institution. It has put in a lot of measures to protect users’ accounts. Some of those measures include 2-step verifications, CAPTCHA requests, duplicate-site tracking etc.

It’s also important for us to mention that you have a really huge role to play in keeping your funds secure. Since we want to this Payoneer review to be comprehensive, we’ll list out some of the things you can to do to keep your Payoneer account safe.

- Keep your Payoneer username and password safe. Ignore requests to share them via email, phone or even social media.

- Do not share your Payoneer OTPs (One-time passwords), pins or verification codes with anyone.

- As much as possible, avoid using Payoneer over public WiFi as you run the risk of exposing your login details to scammers.

Payoneer Fees

In this part of our Payoneer review, we look at its fees. There are no fees attached for receiving payment through the global payment service and other Payoneer accounts. However, marketplaces can charge you for payments made to you from their platforms.

You’re also charged 3% of the sum received by you when you bill a customer directly. Other fees include:

- Account inactivity fee ($29.95/year) – paid when you don’t complete at least one trnasaction in 12 months.

- Payoneer mastercard charges

- ACH bank withdrawal (1%) – applies when you’re sending money from your PAyoneer account

- Local bank transfer (1%) – applies when you’re sending money from your PAyoneer account

Payoneer currencies & exchange rates

Payoneer Service is available in more than 200 countries throughout the world, however, the currencies it accepts and sends payments in are somewhat limited. Payoneer accepts the following currencies:

- USD US dollar

- EUR Euro

- GBP Pound sterling

- JPY Japanese yen

- AUD Australian dollar

- CAD Canadian dollar

- MXN Mexican peso

Exchanging currencies via Payoneer may mean paying up to 2% more than the mid-market rate. If you’re sending money directly to a receiver’s bank account, you’ll be responsible for this fee. If the receiver has a Payoneer account and you send them money in a major currency, they’ll pay the 2% exchange rate when they’re withdrawing the money to their bank account.

Payoneer helps you to manage currencies by allowing you to move money between Payoneer wallet balances in major currencies for a fee of 0.5 per cent of the transaction amount.

Note that these were Payoneers rates and figure as at the time of writing this Payoneer review. Changes may have been made so check out Payoneer’s website for current rates.

How long do Payoneer transfers take?

Paying and receiving money using Payoneer rarely takes more than one business week. All things being equal, your funds should be in your bank account in 2-5 days of receiving your confirmation email. Users in the US can expect their funds to arrive in their bank accounts in 2-3 days but are advised to wait for 5 days before contacting customer service.

Payoneer Mastercard

Payoneer offers its own prepaid MasterCard that may be used to withdraw money from ATMs or to shop online. Getting one isn’t mandatory as you can transfer your funds to your local account and withdraw directly from there.

There are benefits to having a Payoneer Mastercard though. For instance, it gives you direct access to yothe money in your Payonner account, removing the need to first transfer to a local bank account. However, you have to be eligible for one and there is a yearly fee attached.

To wrap up this Payoneer review:

Payoneer is a safe e-payment provider. With 21 offices around the world and a 5 million strong customer base, the Payoneer service seems bent on sticking around for a while. To make the best of the platform, we suggest that you, as much as possible, pay or receive money in your country’s currency via a Payoneer-to-Payoneer transfer. It’s the best way we found to avoid incurring Payoneer fees.

You can also save money by keeping currency conversions low. Thanks to its many partners, you can receive payments from major marketplaces as a freelancer, online seller or affiliate marketer. We hope you’ve found our Payoneer review helpful.